As a small business owner, understanding and interpreting your financial statements is crucial for making informed decisions about your business. Financial statements are a snapshot of your business’s financial health, and they can provide valuable information about your revenue, expenses, and overall financial performance.

There are three main financial statements that every small business should be familiar with:

1. The Balance Sheet

This statement provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time. It can help you understand your business’s net worth and how it has changed over time.

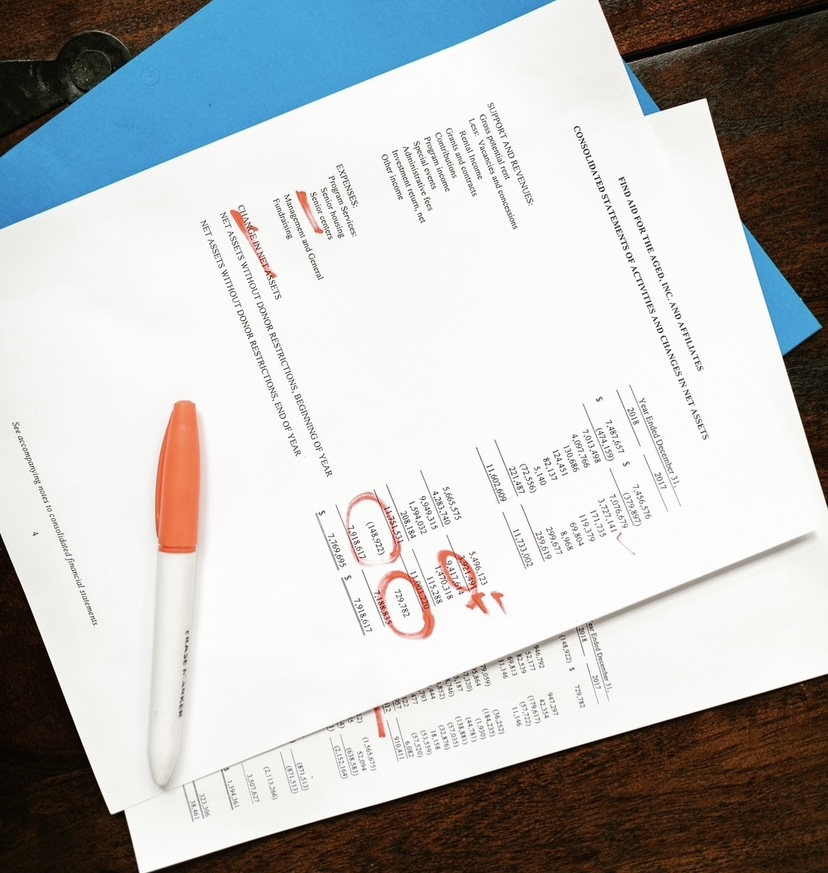

2. The Income Statement

This statement shows your business’s revenue and expenses over a specific period of time, such as a month or a year. It can help you understand your business’s profitability and identify trends in your revenue and expenses.

3. The Cash Flow Statement

This statement shows the movement of cash in and out of your business over a specific period of time. It can help you understand your business’s cash flow and identify potential cash flow issues.

Interpreting financial statements can be a challenging task, but there are a few key things to keep in mind:

Compare to industry benchmarks

Compare your financial statements to industry benchmarks to see how your business is performing in relation to others in your industry.

Look for trends

Identify trends in your financial statements over time to see how your business is changing and to identify areas that need improvement.

Seek advice

If you’re unsure about how to interpret your financial statements, seek advice from a professional, such as an accountant or financial advisor.

By understanding and interpreting your financial statements, you can gain valuable insights into your business’s financial health and make informed decisions about your future. With the right knowledge and tools, you can use your financial statements to create a roadmap for success.

Francis Fabrizi

Accountant

Keirstone Limited